black Digital Warranty in BLOCKCHAIN

Black is a digital insurance company in our blockchain. Our platform connects insurance brokers directly to the capital to provide an opportunity for their own virtual insurance company. For this reason, the removal of trusted third parties (insurance companies) from the value chain in the 1600s. Edward Lloyd runs a London coffee shop, where merchants, bankers and crewmen do business. Lloyd is well known for providing the best information on transportation, related risks, and other similar issues. It became a popular place for two classes of people to meet: those who wanted to insure their boats from major damage and others who were willing to take risks and pay compensation when it happened. In order to insure a possible fraction, the risk taker begins receiving money or insurance premiums. Modern Insurance Market As We Know It

Black is here to make a difference.

Black will use the blockchain to transfer the risk directly from the customer.

(Insured) in financial support. (Black Token Syndicate Token);

- Reduce all inefficiencies.

- Store all the data safely in the blockchains.

- Transparent business practices using smart contracts.

- Fast innovation by platform members.

Black will fix the basic insurance industry. Black is the insurance platform like Lloyds of London on a blockchain day, with no late fees and bureaucracy that we witness today.

Black insurance uses two types of tokens:

- Black Platform Token (BLACK)

The BLCK empowers the infrastructure to gain access to the platform and perform system update rolls to the platform. All tokens will use BLCK to manage insurance on the Black platform and BLCK requirements will increase as the insurance industry is operating on more platforms.

- Black Syndicate Tokens (BST)

(Issued when the platform is ready). BST is an investment in a sum insured and a specific BST is created for each organization. (Security tokens). The profitability of insurance contributions for a particular shipment will be passed to its holder of BST.

Our solutions

Black will be a licensed insurance company that provides insurance capacity. Agents and brokers Mga (hereinafter "brokers") make them to launch their own virtual insurance company. Our capabilities come without the traditional overhead of insurance companies, while using blockchain as the primary platform for eliminating central insurance companies.

We associate ideas with capital directly, replacing unnecessary partners in the value chain with technology. We will do this through crowdfunding and retail investors. The slimmer model places more emphasis on insurance brokers and regulates the products sold. The insurance companies we know today are just reliable third parties - the blockchain gives us the option to operate and The need for insurance is lost.

Cost analysis

We have analyzed information about insurers registered in various markets around the world. We will show that the costs incurred by the standard insurance company Black are almost eliminated is very important. We have collected financial information from insurance companies abroad and Estonia.

Between 2013 and 2016, data show that administrative costs are relatively high in the industry, so many cost cuts are possible. It is also clear that small insurance companies are at the forefront because their administrative costs are relatively high compared to gross premiums.

Insurance companies charge for administrative expenses and net premiums. The industry average is 20%. This data is calculated by calculating the average sum of the administrator's data and the net earnings of the insurance companies included in this blog post.

Black collects fees from users to use different platforms for execution. For example: The Association of Insurance Product Funds with Capital The black insurance fee is a percentage of GWP (Gross Written Premium) fees to be paid on the BLCK Card. The Black Foundation will sell the mark on the market to cover operating expenses: human resources development, legal and administrative costs. marketing Excess of the tokens is stored in the company's spare part for the occasion when the cost increases and the platform usage drops.

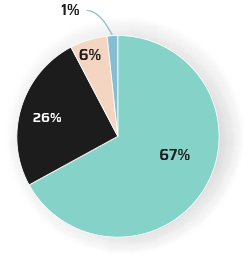

Spread Token

- Token name: Black Platform Token

- Symbols: BLCK

- Soft hat: $ 2,000,000

- Hard Cap: US $ 45,000,000

- The maximum volume that assumes all tickets are sold with maximum discount: 471,082,089

ICO structure:

- Pre-Sale starts - 31/07/2018

- Pre-Sale Duration - 30

- Pre-Sale Cap - $ 15,000,000.00

- Pre-Sale deals - First week 25% bonus after first week and 20% bonus.

- Token started selling - 8/31 / 2018

- Token Sale Period - 30 days

- Soft hat - $ 2,000,000.00

- Hard Hat - $ 45,000,000.00

- Token Symbol - Blck

- Tokens - 471 082 090

- Exchange Rate - 1BLCK = 0.2 USD

- Minimum Purchase - $ 100.00

- Accept Cryptos - BTC, LTC, ETC

Can be adjusted - the tokens are not distributed. Break by the token contract.

Items - BLCK symbols will be provided in the exchange of secrets.

Advantages of Token Holder - BLCK can be used to pay for services on the Black Black platform. It is guaranteed that on January 1, 2064, the fee paid to BLCK will be less than the fee paid in other currencies. 20%

Restricted Token-Only Trade-Only Teams and Advisors who have a licensing period and sales.

Our road map

- October - November 2017 Organize concept and team

- Nov 2017 Product Concept Ready

- December, 2017 seed financing

- May, 2018 MVP launches

- Summer 2018 ICO General Sale

- December, 2018 launch platform

- Summer of 2019, EU license

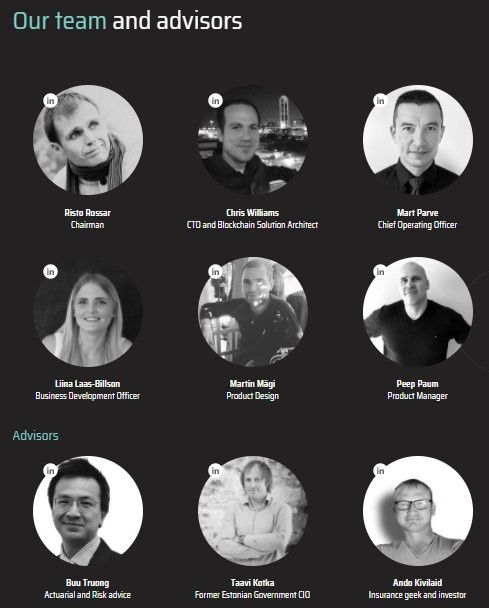

team

For more Information:

Website: https://www.black.insure/

Whitepaper: http://www.black.insure/docs/

Twitter: https://twitter.com/BlackInsure

Facebook: https://www.facebook.com/blackinsure

Telegraph: https://t.me/blackinsurebot

AUTHOR:Gajahduduk

ETH:0xcE85485e61cd0FB845b84F4e99Bc291bcA89D640

Komentar

Posting Komentar